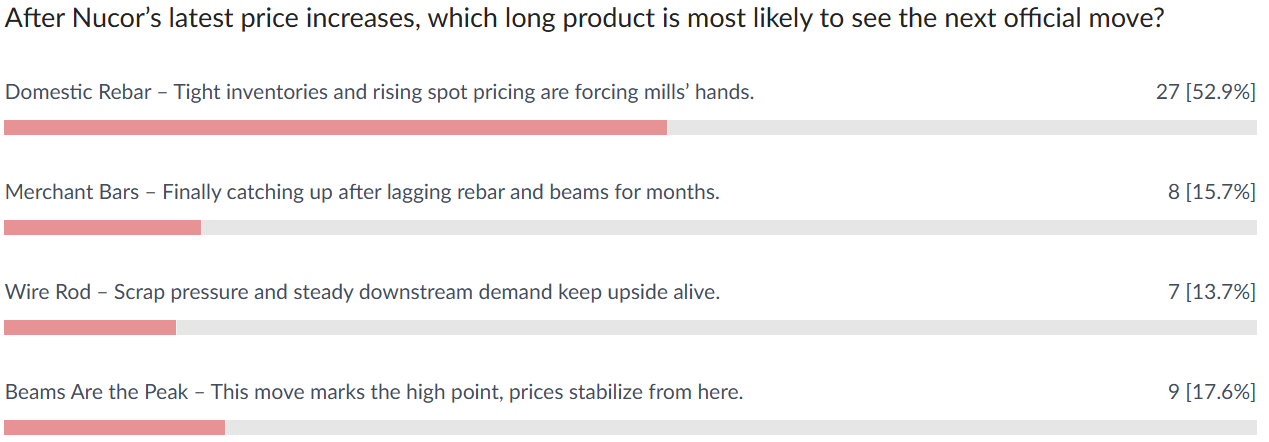

Updates From This Week Supply Volatility Remains a Key Concern Steel professionals who flocked to the World of Concrete expo in Las Vegas returned with a largely optimistic outlook. While rebar fabricators and concrete contractors are less busy than in previous years, they report healthy demand and backlogs that should sustain operations at least through mid-year. The Rebar Supply Wildcard While consumption remains steady, rebar supply is the industry’s primary wildcard. In 2025, import volumes plummeted to their lowest levels in over a decade after steel tariffs doubled to 50%, compounded by a significant anti-dumping filing. Though recent domestic price increases have made imports workable again, options remain limited due to ongoing cases against major exporters in Vietnam, Egypt, Algeria, and Bulgaria. Turkey delivered several substantial shipments in December, and South Korea has emerged as a significant potential source to replace sidelined countries. Several large Korean mills have boosted exports to the U.S., driven by depressed steel prices in Southeast Asia. Market Cautions and New Capacity Buyers are now concerned that a surge of Korean shipments arriving in Q1 and Q2 could erode currently elevated price points. Furthermore, the market is watching two new domestic mills — Hybar and Nucor Lexington — which are expected to increase domestic output significantly. Current domestic prices carry healthy margins; however, these could drop if mills are forced to lower prices to protect market share or fill production schedules. Consequently, buyers are becoming more cautious about committing to new import arrivals, which are now extending into June and July 2026. Wire Rod Trends On the rod side, buyers are booking Q1 and Q2 arrivals, albeit at a conservative pace. Liberty Steel has yet to reach full production, and other domestic mills remain busy. Unlike the rebar sector, no "flood" of imports is expected for wire rods in the first half of the year. Attractive pricing and a desire to hedge against domestic supply interruptions continue to make imports a viable strategy for the American wire producers. Weekly Poll What factor will have the biggest impact on long-product pricing over the next 60–90 days? Last Week's Poll Result 🏗️ StaalX Successfully Exhibited at World of Concrete 2026!Thank you to everyone who stopped by Booth #N3368 to see a live demo of the digital steel marketplace reshaping how the industry sources concrete reinforcements — including rebar, wire rod, welded wire mesh, and merchant bars. The conversations, feedback, and interest we saw throughout the show reinforced one thing clearly: the industry is ready for more transparent, efficient, and data-driven steel procurement. 🔥 Show Highlights:

We appreciate everyone who joined us, shared insights, and helped make World of Concrete 2026 a great success. More updates coming soon. Explore the upgrades at www.staalx.com or get in touch today with websupport@staalx.com to see the difference. 🎧 Missed Episode 15? Catch up now — in this episode, we break down why data is pointing to strong years ahead for concrete construction, even as contractor confidence remains cautious. We discuss how data centers, power infrastructure, and domestic manufacturing are quietly reshaping demand, and why sentiment on the ground hasn’t fully caught up with the fundamentals. From regional migration and infrastructure spending to elevated material and labor costs, this episode explains what’s actually driving today’s construction cycle — and what contractors, suppliers, and concrete producers should be watching as we head into 2026. Listen now on ▶️ YouTube | 🎵 Spotify | 🎙 Apple Podcasts 👉 Follow the StaalX Construction & Steel Podcast for weekly insights on market shifts, freight trends, and sourcing strategies. From our content partner, SteelOrbis US domestic weekly long steel prices finish mixed as January scrap prices continue higher Thursday, 15 January 2026 23:51:36 (GMT+3) San Diego US domestic long steel prices were mixed this week with rebar pricing continuing higher while wire rod values were reported flat from the previous week, market insiders told SteelOrbis. Insiders said rising scrap prices for January delivery and dwindling levels of imports continue to support finished steel pricing. And, as domestic prices continue higher, insiders said they expect an increase in the number of imports for the first quarter of 2026. Market reports have described flat to potentially lower prices on the import side. "More imports could cool (domestic prices increase) off a bit, though for now, supplies remain very tight,” said a long steel insider. Domestic mills have been pressed to increase their pricing due to recent Nucor announcements. On January 11, 2026, the Nucor Bar Group has increased prices by $1.50/cwt ($30/ nt or $33/mt) on all rebar products. This is following the most recent Nucor statement on January 6, 2026, from its Nucor Bar Group announcing a price increase on most merchant and structural products by $2.50/cwt ($50/nt or $55/mt). In the weekly rebar spot markets, domestic supply on an FOB mill basis was assessed with most transactions noted at $48.00-49.00/cwt, ($960-980/nt or $1,058-1,080/mt), on average $48.50/cwt, ($970/nt or $1,069/mt), up $1.50/cwt ($30/nt or $33/mt) from last week. On the domestic long steel demand side, weekly discussions have continued about the US construction industry and its current demand drivers. “I have mixed feelings on the construction market. Data center and highway construction are busy, but the rest is a bit slow. Texas seems to be good, whereas states like California are slow,” said a SteelOrbis insider. In the domestic wire rod market, domestic supply on an FOB mill basis was assessed with most transactions reported this week at $48.00-49.00/cwt ($960-980/nt or $1,058-1,080/mt), or an average of $48.50/cwt ($970/nt or $1,069/mt), unchanged from a week ago. The domestic wire rod demand has been described as “slow but steady” by another long steel insider. US import long steel prices stable on domestic price strength; imports could rise Thursday, 15 January 2026 20:55:11 (GMT+3) San Diego US import rebar and wire rod prices were mostly steady this week, even as domestic long steel prices were steady to higher, lead by continued tariff-reduced finished steel supply, steady but unremarkable demand, and continued strength in local scrap markets, market insiders told SteelOrbis this week. While many of the same supportive fundamentals for domestic long steel production continue, such as data center build activity, insiders said continued strength in steel scrap pricing has been key in determining long steel price direction of late. On the US Gulf Coast, import rebar on a loaded truck basis is discussed at $45.00-47/cwt., ($900-940/nt, or $992-1,036/mt), unchanged from one week earlier. US East Coast rebar at the “pier” is talked at $45.00-46/cwt., little changed from week-ago levels, market insiders told SteelOrbis. “Domestic rebar pricing held firm before CMC implemented a $30/ton ($1.50/cwt) price increase, immediately following (higher) January scrap settlements,” said one US Gulf Coast rebar insider. “Spot pricing remains at multi-year highs, supported by tight domestic supply, limited import replenishment, and rising raw material (scrap) prices.” During recent January scrap negotiations, most US domestic scrap grades rose an additional $20-30 a gross ton (gt). In December and January trade alone, US Midwest shredded scrap prices -the US rebar benchmark scrap grade- has increased a total of $50/gt to $415-420/gt ($422-427/mt), a nearly 8 percent gain. During the same time period, US domestic rebar pricing rose about 4.3 percent. Long steel insiders say recent announcements of price increases from domestic mills could continue as domestic supply continues to tighten. Following a January 9, $1.50/cwt., price increase from Commercial Metals Company (CMC), Charlotte, North Carolina-based Nucor announced its own $30/nt price increase on sales of domestic rebar. Insiders told SteelOrbis they were surprised Nucor followed CMC’s announcement, as Nucor usually leads price announcements, though it demonstrates the continued paucity of domestic rebar supply “on the ground,” they said. At current, domestic rebar and wire rod stand at parity at $48.00-49/cwt., ($960-980/nt or $1,058-1,080/mt), with rebar up about $1.50/cwt., on the week, market insiders told SteelOrbis. Wire rod was flat to week-ago levels, though could be poised to rise soon as inventories dwindle, insiders said. “Imports are getting more traction on rebar as a result of recent domestic price increases,” said another US Midwest long steel insider. “The gap between import pricing and domestic prices is increasing, which could signal that more imports likely are on their way to the US.” Insiders told SteelOrbis they expect more inbound long steel deliveries from Turkey and Korea during February, March and April. “Once the increased imports start to flow, we could see some softening for domestic pricing,” the insider added. In the import wire rod market, wire rod mesh on a DDP loaded truck basis US Gulf is discussed steady on the week at $44.00-45/cwt., ($880-900/nt or $970-992/mt), despite a recent $40/nt price increase from Nucor ($2.50/cwt.) on engineered mesh products. “Import wire rod and wire mesh prices remain competitive but have not disrupted domestic pricing, given tariff exposure, logistics, and ongoing buyer behavior,” said one US Gulf Coast long steel insider. “Demand is slow but steady, typical for the season.” The long steel insider added that reports on the status of the Liberty Steel wire and rod plant indicate the Peoria, Illinois-based unit is running at less than full capacity. Calls to confirm ongoing operations at Liberty Steel by SteelOrbis were not returned as of press time. February US scrap seen stable to up $20/gt, winter storm could disrupt inbound flows, shred ops Thursday, 22 January 2026 21:51:41 (GMT+3) San Diego For a second straight week, US domestic scrap prices for February delivery were expected to settle sideways to potentially $20/gross ton (gt) higher, market insiders told SteelOrbis in an exclusive weekly survey of market participants. And, as steady to higher scrap prices for a third straight month seemed more imminent as monthly scrap negotiations for February draw nearer, a developing forecast for abnormally cold and snowy weather across nearly half of the US late this weekend could further trim stocks of US scrap at supply yards as well as further complicate deliveries, insiders said. “With shredded scrap, inbound flows will slow way down causing shredders to springboard prices if this cold front stays in place for a week or so,” remarked one US Midwest scrap supplier to SteelOrbis. “Flows already are low, but it’s going to just get harder to maintain inventory.” According to short-term weather forecasts, the approaching winter storm, currently developing over the US West Coast, is expected to affect the transport of steel and scrap in more than 35 states, many of which could see accumulations of more than a foot of snow. Characterized by forecasters as a storm of “high impact and long duration,” significant ice accumulations across the US South as far as Texas are expected to result in significant road closures, potential power outages, and dangerous conditions, they said. “If the weather gets as cold as predicted, it will force us to shut all of our trucks down,” the scrap insider added, noting that extreme cold weather below 15 degrees Fahrenheit causes diesel fuel in truck fuel tanks to gel, as paraffin wax crystallizes, clogging fuel lines. “We’re hearing sideways currently for February scrap grades from the mills, but, dealers are still trying to ride the December-January optimism into February,” said another US mid-continent scrap dealer. “We’re hearing sideways all day long,” commented one mill-based scrap buyer to SteelOrbis. One New York state-based scrap supplier said, “We’re expecting to see possibly up $15-20/gt across all grades. Following recent January SteelOrbis monthly scrap settles, which saw US pricing rise $20-30/gt across all regional US scrap grades east of the Mississippi River, a steady to higher February pricing outcome would mean that scrap prices will have risen by nearly 10 percent since the conclusion of November scrap negotiations. Based on a sideways to $20/gt increase in February scrap prices, US Midwest busheling scrap could settle at $425-440/gt ($432-447/mt), while February shredded material could settle near $418-435/gt ($425-442/mt. P&S and HMS scrap could settle near $411-426/gt ($418-432/mt), and $380-395/gt ($386-401/mt), respectively. On the US east Coast, a sideways to up $20/gt settlement could yield February busheling scrap settlement prices near $385-405/gt ($391-411/mt), while February shredded scrap could finish near $375-390/gt ($381-396/mt). In P&S and HMS grades, a sideways to $20/gt higher settlement would yield a P&S scrap settle near $340-355/gt ($345-361/mt), while February HMS 80:20 scrap might settle in the range of $358-373/gt ($364-379/mt), on a delivered to export yard basis, market insiders said. In the US export scrap markets, SteelOrbis overseas scrap insiders reported increasing resistance from local mills against higher price offers or current prices, following the conclusion of most of their February supply procurement. SteelOrbis believes Turkish mills have concluded at least 22 deep sea scrap deals and now have enough time left to exert pressure on prices for the remaining deals to be done for shipment during late February and early March. Do you have any questions? Check out our FAQ!Check out the most frequently asked questions about the service and products of StaalX. We are always here to chat with you in the chat boxes from the site or on the support telephone number below. Contact us websupport@staalx.com or +1 (708) 697-3227 Follow StaalX on |

Do you want to get an instant quote?

Find rebar, wire rod, wire mesh and other construction materials on StaalX. Check availability and order with reliable delivery nationwide.

Browse products →

.jpeg)

.jpeg)