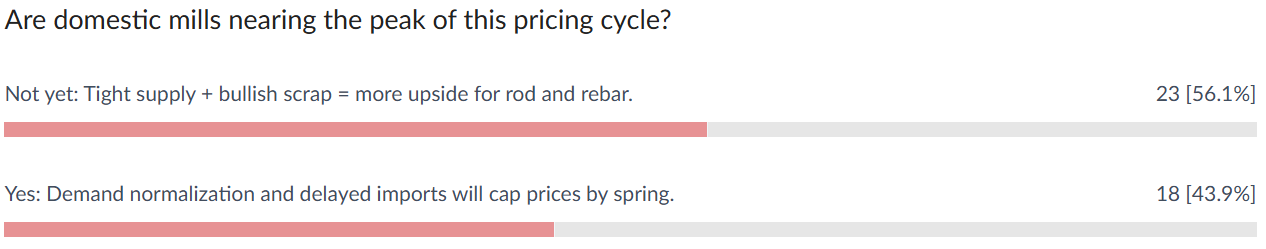

Updates From This Week Which Products To Watch NextNucor Structurals has wasted no time in the new year, announcing price increases of $60/ton for beams and $50/ton for merchant bars. While this marks the first adjustment for merchant bar categories since July, the move signals a shift in momentum for long products. Merchant bars have historically lagged behind the "red hot" rebar and beam sectors, but that may be changing. Domestic rebar could be the next to see an official increase, as spot prices rise and inventory—particularly 20-foot lengths—remains in short supply. The upward trajectory is supported by a $20–$40/ton anticipated rise in January scrap prices, which should sustain pricing momentum across all steel segments through Q1. Flat-rolled products are also following suit; hot-rolled coil remains the strongest performer, followed closely by cold-rolled and coated products. Interestingly, for the flat rolled products the import market is showing signs of life. After a quiet second half of 2025, imports are becoming competitive again. Despite the 50% tariff handicap, current domestic pricing has brought imports back "into the ballpark," and a wave of new bookings is expected to follow. Despite lingering fears of a slowdown or runaway inflation, the U.S. economy continues to hum. With major economic indicators pointing toward a robust first half of 2026, the steel market appears well-positioned for a strong start to the year. Weekly Poll After Nucor’s latest price increases, which long product is most likely to see the next official move?

Last Week's Poll Result 🏗️ StaalX Exhibits at World of Concrete 2026!Come see us at Booth #N3368 for a live demo of the digital steel marketplace that’s reshaping how the industry buys concrete reinforcements — including rebar, wire rod, welded mesh, and merchant bars. 🔥 Show-Only Bonus:

No strings attached. Just our way of saying thanks for visiting. Explore the upgrades at www.staalx.com or get in touch today with websupport@staalx.com to see the difference. 🎙️ Missed Episode 14? Catch up now — in this episode, we break down why steel prices are staying firm despite uneven construction activity, how AI infrastructure and data center demand are propping up long products, and why margin pressure is becoming the defining challenge for contractors and developers alike. From tariffs and reduced import competition to wage growth and pricing volatility, this episode explains what’s really driving today’s steel market — and what contractors, suppliers, and project owners should realistically expect in the months ahead. Listen now on ▶️ YouTube | 🎵 Spotify | 🎙 Apple Podcasts 👉 Follow the StaalX Construction & Steel Podcast for weekly insights on market shifts, freight trends, and sourcing strategies. From our content partner, SteelOrbis US domestic rebar increases while wire rod stays steady early 2026 Thursday, 08 January 2026 21:20:31 (GMT+3) San Diego US domestic rebar prices increased while wire rod prices stayed flat in the first week of 2026, as scrap was steady to higher in December and described by an insider as having a “renewed upward momentum” for January. The upwards expectations coupled with demand were enough for rebar and scrap price increases, but not for wire rod pricing. As of January 6, 2026, Nucor released a statement from its Nucor Bar Group announcing a price increase on most merchant and structural products by $2.50/cwt ($50/nt or $55/mt). “Rebar pricing has moved quite quickly and has pretty much caught up with wire rod prices,” a long steel insider said. In the weekly rebar spot markets, domestic supply on an FOB mill basis was assessed with most transactions noted at $46.50-47.50/cwt, ($930-950/nt or $1,025-1,047/mt), on average $47.00/cwt, ($940/nt or $1,036/mt), up $0.50/cwt ($10/nt or $11/mt) from two weeks ago. On the domestic long steel demand side, weekly discussions with market insiders again focused on the US construction industry and its current demand driver in new data center construction projects, government and medical construction projects, and infrastructure projects, when compared with the slower residential and commercial construction activity. In the domestic wire rod market, domestic supply on an FOB mill basis was assessed with most transactions reported this week at $48.00-49.00/cwt ($960-980/nt or $1,058-1,080/mt), or an average of $48.50/cwt ($970/nt or $1,069/mt), unchanged from two weeks ago. US import long steel prices steady to higher as domestic prices rise Thursday, 08 January 2026 19:41:29 (GMT+3) San Diego US import long steel pricing was steady to slightly higher this first post-holiday week of 2026 as rising domestic long steel prices are reported to be allowing the entry of an increased amount of steel imports into US ports, market insiders told SteelOrbis this week. As previously reported by SteelOrbis, reports of low import-inspired domestic supplies on hand, consistent demand support from the US data center build sector, and a forecast for higher scrap pricing during January and now, potentially, February, continues to boost the short-term domestic long steel pricing outlook. Market insiders told SteelOrbis imports from abroad are on the rise as domestic spot rebar values at $47.00-48/cwt., (up $1.00/cwt this week) have now risen to previously identified price levels where imports could begin to be more competitive with domestic material from a purely price perspective. “Yes, long steel imports into the US are starting to gain some traction, but still not really very much more is coming in than we saw during the summer of 2025,” remarked one Midwest long steel market insider to SteelOrbis. “We’re now starting to see some limited amount of material coming into the US from countries such as Korea and Turkey as domestic prices continue to rise.” Prior to the US holidays, long steel insiders told SteelOrbis US mills were very reluctant to increase long steel pricing for fear that doing so would cause an influx of new competitive imports. Like previous weeks, insiders continue to say the slow pace of the current US economic recovery has continued to keep domestic long steel demand “steady but limited,” even as tariff-reduced rebar and wire rod inventories continues to be an issue, especially for spot buyers on the US Gulf Coast. A seasonal lull in finished steel demand, especially during the US holiday period stretching from Thanksgiving through New Years, they said, was expected to limit further long steel price increases through the end of 2025. Previous SteelOrbis market reports found most survey respondents expect a continuation of steady to higher steel pricing for Q1 2026. On the US Gulf Coast, import rebar pricing on a loaded truck basis was reported $0.50/cwt., higher for the first week of 2026 at $45.00-47/cwt., ($900-940/nt or $992-1,036/mt), or on average $46/cwt. Spot import rebar pricing at US East Coast ports was reported $0.50/cwt., up at $46.00-46.50/cwt. On the long steel demand side, media reports indicate demand from the US construction sector remains mixed, with total construction starts during the month of November off nearly 21 percent from October levels while non-residential building starts fell 13.4 percent and residential starts rose by 13.3 percent. Year over year construction starts for November were reported up a mere 1 percent, while non-residential starts rose 5.2 percent and residential starts fell by 3.7 percent. Reports note higher construction input costs, with copper and steel prices up sharply, while diesel prices remained steady, they said. “I think the current outlook for [long steel] pricing is encouraging,” noted one import market observer, “based on a continuation of scant domestic supply and the outlook for higher January scrap.” In the local US scrap markets, January shredded scrap is seen $30/gt ($30.48/mt) higher than equivalent December settle values at $415-420/gt ($422-427/mt). Another round of reports circulated this week that Tampa, Florida-based Gerdau steel was offering $30/gt premiums for all US steel grades with the exception of prime materials, where pricing was to be determined. Insiders reported to SteelOrbis that Midwest prime scrap -following December’s $20/gt increase- could trade on average $20/gt higher versus December settles during January supply negotiations that are expected to conclude later this week or early next week. During December scrap buy-cycle negotiations, initial reports on Gerdau offering higher prices sparked average $10-20/gt gains across the board for December scrap. On the wire rod front, imported mesh material on a DDP loaded truck basis US Gulf is quoted in continued thin trade at $44.00-45/cwt., ($880-900/nt or $970-992/mt), up from $42.00-43.00/cwt., ($840-860/nt or $926-948/mt), following recent Nucor announcements of additional $40/ton ($2.00/cwt.) increases in domestic wire rod prices. And, while it remained unclear at last report whether the US spot market would accept the higher price offers on engineered wire mesh pricing from Nucor, continued supply tightness in local markets and a higher likelihood for rising January scrap pricing this week appears to have increased market acceptance of Nucor’s new pricing offers, insiders said. January US scrap seen $20-40/gt higher as weather limits output amid reports of mill restocking programs Friday, 02 January 2026 11:40:31 (GMT+3) San Diego This week’s poll of SteelOrbis scrap market insiders reveals most think January US ferrous scrap pricing could settle $20-40/gt ($20-41/mt) higher during monthly scrap supply negotiations, which could begin next week following the New Year holiday. While responses to the weekly SteelOrbis scrap market poll remained limited because of the ongoing US Christmas and New Year holidays, the weekly market expectations remained little changed, except that fewer respondents expect steady or flat January pricing against December levels. Last month, US average scrap prices settled $10-20/gt ($10-20/mt) higher amid cold weather in the US Midwest and Northeast regions that reportedly hampered operations, even as market insiders reported improved export sales from the US East Coast, causing monthly scrap prices to move $10-20/gt ($10-20/mt) higher across all scrap grades. “Some of my US (contacts) are saying plus $20/gt on cut grades (HMS and P&S), while up $30-40/gt is possible for primes (busheling and turnings),” said one US Midwest scrap insider. “I’m hearing that another bump in pricing is possible for February,” he added. “That’s pretty much the extent of the bullish run for ferrous (scrap) in the US for the foreseeable future.” Insiders told SteelOrbis harsh winter weather across the US Midwest continues to limit scrap production capacity, even as demand is expected to improve next month as mills seek to restock inventory via “important purchasing programs”. “We’re hearing up $20-30/gt for January,” another US Midwest mill-based scrap insider reported to SteelOrbis. “With the holidays in full effect, there’s really very little new to report on January scrap,” reported yet another US Midwest scrap broker. “I’m thinking we’ll be up $20/gt across the board.” Based on an average $30/gt potential increase, Midwest shredded scrap pricing is seen settling as high as $415-420/gt ($416-421/mt) delivered to mill, while busheling scrap which gained $10/gt during December negotiations, could settle near $425-435/gt ($431-441/mt) if higher expectations for January prove true. In Ohio Valley HMS and P&S grades, a $30 average January price increase could net settled prices at near $365-385/gt ($370-390/mt), and $401-411/gt ($396-407/mt), respectively, on delivered to mill basis. In the US Northeast, scrap insiders said a continuation of recent increased export demand could boost January scrap values as importers buy an increased amount of US supply towards February scrap requirements. January shredded grades are seen potentially up on average $30/gt on a delivered to mill basis from $20/gt higher December settled prices at $365-375/gt ($371-381/mt), while busheling scrap could settle on average $30/gt higher at $380-400/gt ($385-405/mt). For cut grades, a $30 increase would net January settled prices near $345-350/gt ($351-355/mt) for HMS I/II, while P&S scrap could settle $30 higher near $330-340/gt ($335-345/mt). Much of the anticipated January scrap and finished steel price increases, insiders said, could depend on whether National Weather Service short-term forecasts for an increased amount of cold and snowy weather in the US Midwest and Northeast regions proves true, and whether US mills, following a December scrap price increase, have much of an appetite left to absorb the additional cost of higher January scrap given a normal seasonal drop in demand. Additional steel production price increases, scrap insiders say, could net additional finished steel price increases that could encourage another influx of imports early in the new year. Do you have any questions? Check out our FAQ!Check out the most frequently asked questions about the service and products of StaalX. We are always here to chat with you in the chat boxes from the site or on the support telephone number below. Contact us websupport@staalx.com or +1 (708) 697-3227 Follow StaalX on |

Do you want to get an instant quote?

Find rebar, wire rod, wire mesh and other construction materials on StaalX. Check availability and order with reliable delivery nationwide.

Browse products →

.jpeg)