| | | |

Scrap and Flat-Rolled Price Increases May Reignite Long Products in January

|

|

While December is traditionally the slowest month for steel sales, the current market is active, prices are rising, and the upward trend is projected to continue well into Q1 2026.

Since the doubling of steel tariffs in June 2025, prices have risen across the board. Now, flat-rolled steel is joining the momentum, with Nucor posting seven consecutive weeks of price increases. As flat-rolled products dictate the majority of the steel produced and consumed in the U.S., their upward movement naturally lifts the scrap market. Consequently, scrap prices are expected to rise by approximately $20 per ton in December.

The significant price increases for long products in the U.S., while the rest of the world’s steel pricing has stagnated, are once again making imports viable. Imports may be the only source of relief for steel consumers in the first half of the year. Rebar and wire rod shipments are now being arranged for Q1 arrivals; however, December and January arrivals are sparse. This has left master distributors with major inventory gaps, making some sizes and grades impossible to find for quick delivery.

Although a few domestic rebar mills are ramping up production, steel mill start-ups are complex and typically involve significant initial problems that need to be sorted out before full capacity is reached. Furthermore, there are no new rod mills planned in the near term (with Hybar being the earliest possible addition in a few years).

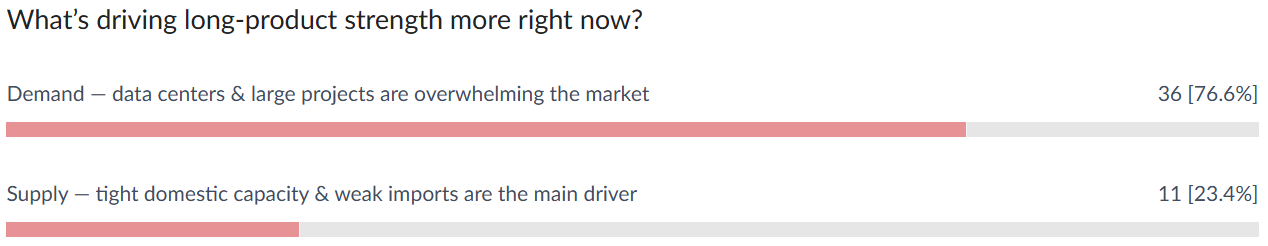

The better-than-expected demand is stemming from a very specific type of construction: data center construction, which continues to boom. Most other non-residential and residential construction sectors are currently cooling off. The construction sector—and the overall U.S. economy—has artificial intelligence investments to thank for keeping market demand humming.

|

| | | With domestic supplies tight and import arrivals sparse until late Q1, when do you expect inventory gaps to finally stabilize? |

| | | | |

🏗️ StaalX Exhibits at World of Concrete 2026! |

|

Come see us at Booth #N3368 for a live demo of the digital steel marketplace that’s reshaping how the industry buys concrete reinforcements — including rebar, wire rod, welded mesh, and merchant bars.

🔥 Show-Only Bonus: - Claim your $500 discount code toward your first truckload order

- Enjoy gifts & giveaways for everyone who stops by our booth

No strings attached. Just our way of saying thanks for visiting.

|

| | | | |

🎙️ Missed Episode 11? Catch up now — we dig into whether commercial construction can maintain momentum in 2026, as mixed signals emerge across the industry.

From the strength of specialized, high-value projects to the challenges facing traditional commercial sectors, Episode 11 explains how these trends are shaping steel demand, pricing expectations, and buyer behavior heading into early 2026.

|

| | | | | From our content partner, SteelOrbis |

| | US domestic rebar and wire rod prices flat; December scrap may trigger price increases

Thursday, 04 December 2025 22:49:16 (GMT+3) San Diego |

|

US domestic rebar and wire rod prices remained flat again this week, even as the potential for higher December scrap pricing could prompt domestic steel producers to announce yet another round of increases in posted prices as steel production costs are likely to rise, long steel insiders told SteelOrbis this week.

On Nov. 7, Charlotte, North Carolina-based Nucor increased its posted prices for rebar by $30/nt ($33/mt), or $1.50/cwt. No more recent rebar increases have been announce to date by the US steel maker.

“I think if scrap is moving up, there will be another price increase coming soon,” remarked one long steel insider to SteelOrbis.

This week, December scrap negotiations are expected to conclude, with shredded scrap seen settling $20/gt ($20/mt) higher, while other grades are seen mostly sideways to potentially higher at last report. Scrap suppliers said Dec. 4 that intense cold Midwest weather has reduced inflows of scrap into collection yards, resulting in a drop in available shredded scrap inventory ahead of the start of December supply negotiations.

“Shredded scrap is up $20/gt, though other grades have not yet been finalized,” remarked another US Midwest mill scrap buyer. “We’re hearing that exports are up, and scrap inflows are a little tight.”

In the weekly rebar spot markets, domestic supply on an FOB mill basis was assessed with most transactions noted at $46.00-47.00/cwt, ($920-940/nt or $1,014-1,036/mt), on average $46.50/cwt, ($930/nt or $1,025/mt), unchanged from seven days ago.

On the domestic long steel demand side, weekly discussions with market insiders once again focused on the US construction industry and its current demand driver in new data center construction projects, when compared with tepid residential and commercial construction activity.

“Small contractors are not busy at all,” commented the long steel insider. “Smaller companies have felt the heavy lull of a slow construction climate over the past few months as data center construction continues to be the main driver of their industry. The bigger you are in construction right now, the better off you seem to be.”

In the domestic wire rod market, domestic supply on an FOB mill basis was assessed with most transactions reported this week at $46.50-47.50/cwt ($930-950/nt or $1,025-1,047/mt), or an average of $47.00/cwt ($940/nt or $1,036/mt), unchanged from seven days ago. Wire rod has remained steady for several months now, amid continued reports of stable supply and demand.

“Not many changes were seen in the market this week, but it remains busy, which is good,” said another SteelOrbis long steel insider. A strong upward market trend for domestic long steel pricing is likely to continue as we end 2025 and start the new year, he said.

|

| US import long steel pricing mostly stable pending outcome of December scrap trade

Thursday, 04 December 2025 19:52:47 (GMT+3) San Diego |

|

US import long steel pricing remained mostly stable in thin trade this week following the long US Thanksgiving holiday, as US steel markets wrestled with the start of December ferrous scrap supply negotiations. While scrap pricing was discussed mostly stable throughout the month of November, this week saw late reports of $20/gt ($20/mt) December premiums from US scrap suppliers and mills.

Market insiders told SteelOrbis higher scrap prices for December could lead to further price increases from US long steel mills, now potentially facing higher steel production costs. Likely competition from imports that may occur as a result though, might temper the amount of increases, they cautioned.

“Right now, import pricing for rebar is stable waiting on the outcome of December scrap,” said one US Midwest long steel importer. “I think we will need to see scrap pricing rise in order for domestic rebar pricing to rise again.”

On Nov. 7, Charlotte, North Carolina-based steel maker Nucor increased is posted prices for rebar by $30/nt or $1.50/cwt. No posted rebar price increases have been reported by the mill since that date, and weekly spot pricing has largely been stable following a brief increase following the Nucor price announcement.

Insiders told SteelOrbis a domestic rebar price approaching $47.00-48.00/cwt.,($940-960/nt or $1,036-1,058/mt), might encourage an “influx” of new rebar imports into the US Gulf Coast and US East Coast markets. Current domestic rebar spot pricing remained steady for a second week at $46.00-47.00/cwt.,($920-940/nt or $1,014-1,036/mt), just short though very near to the stated import price threshold.

“We are out of rebar inventory until the first part of January,” commented one long steel rebar importer, regarding reports of limited import stocks. “So, it’s hard to gauge where imports pricing really is at the moment. As a result, it’s been fairly quiet for us.”

On the US Gulf Coast, following reports of earlier small weekly gains, import rebar pricing on a loaded truck basis was reported steady in a $44.00-47.00/cwt., ($880-940/nt or $970-1,036/mt) range, or on average $45.50/cwt., up from $44.00-46.00/cwt., ($880-920/nt or $970-1,014/mt) reported two weeks earlier. Reports continue to circulate about shrinking supply availability at Gulf Coast and East Coast supply warehouses forcing sellers to seek higher pricing for available but shrinking inventory.

On the US East Coast, import rebar on a loaded truck basis was assessed slightly higher versus week-ago levels at $44.00-47.00/cwt., ($880-940/nt or $970-1,036/mt), once again, on par with US Gulf Coast pricing.

“East Coast rebar is priced at $44.00-47.00/cwt, with maybe some lower pricing mentioned than $44.00/cwt., though I kind of doubt it,” remarked one US East Coast rebar importer. “Now that the [Nucor domestic] price increase is fully in effect, it will be interesting to see who holds and who folds [on pricing]. We have had some customer push back, but I have not seen the mills budge as of yet,” he said. “Customers are pushing back because it is not that busy out there, and they don’t want to get stuck with rebar at a higher number if the mills do decide to drop their prices. I don’t see that happening, but that’s the feedback we are hearing.”

On the supply side, as Q1 2026 import rebar arrivals from Turkey, South Korea, and Malaysia are forecast to rise as a result of recent increases to domestic prices, market insiders said import rebar prices for the first three months of 2026 is likely to average $44.00-45.00/cwt ($880-900/nt or $970-992/mt), little changed from price levels quoted in early June, prior to new anti-dumping (AD) investigations announced by the US Dept. of Commerce (DOC) against Algeria, Bulgaria, Egypt, and Vietnam. A final determination from the DOC is expected by Jan. 26, 2026.

SteelOrbis import data for the first eight months of 2025 shows total imports of rebar from abroad at 638,136 metric tons (mt), just short of 80,000 mt a month. Recently market insiders told SteelOrbis total imports for all of Q4, 2025 would average about 50,000 mt as a result of curtailed shipments from countries currently under AD investigations.

On the import wire rod front, US Gulf Coast import pricing for wire rod mesh on a DDP loaded truck basis remains steady for yet another week at $42.00-43.00/cwt., ($840-860/nt or $926-948/mt).

|

| December scrap seen sideways to $20/gt up as winter weather reduces shredded supply

Thursday, 04 December 2025 06:25:00 (GMT+3) San Diego |

|

While monthly scrap trade is not expected to conclude in the US until at least Dec. 5, December scrap pricing is likely to settle sideways to at least $20/gt ($20/mt) higher as inventory of shredded scrap supply is reported low and the effects of cold and snowy weather are expected to continue to reduce inflows into local collection facilities, market insiders told SteelOrbis this week.

While the December outlook remained sideways for nearly a month, shortly after the US Thanksgiving holiday, market insiders began to report to SteelOrbis an expectation for potentially higher December scrap prices. That higher scrap price forecast focused almost exclusively on shredded scrap.

“To me it appears that the market is up $20/gt and shred might be up more as shred feed is very minimal,” reported one Midwest-based scrap supplier. “Gerdau down south is up $20/gt across the board which makes me think that shred is probably going to have the highest demand in snow regions.” He continued, “Peddlers are not coming in [to the yards] because of the weather. Cold weather is having a big impact on retail scrap flows in snow belt regions, plus export is seeing better demand. Tomorrow, temperatures are expected to drop to 11 degrees [Fahrenheit] in northeast Ohio.”

The US snow belt is a region known for heavy snowfall, primarily in areas to the south and east of the Great Lakes, parts of western New York, Michigan, Ohio, and Pennsylvania, where cold air picks up moisture from warmer lake waters and deposits it as bands or belts of heavy snow.

The US Midwest supplier predicted scrap prices, especially for shredded scrap, could rise between $50-70/gt between now and February because of dwindling inventory and forecasts for cold and snowier weather this year as a result of a developing La Nina weather patterns that will focus on the upper Midwest, the Great Lakes region and parts of the Northeast.

“Shred is up $20/gt, but other grades are not yet finalized,” said still another Midwest mill-based scrap buyer. While other grades remained up in the air as of press time, a developing consensus for the week seems to indicate a mostly sideways sentiment, though some insiders in late trade Dec. 4 cautioned that the amount of sideways scrap available to mills might be limited.

“The chatter in this market right now is that scrap could be up $70/gt come February, so why sell scrap at sideways in December,” the Midwest supplier added. “To my thinking sideways is still questionable and we could very well see obsolete and shred up $20/gt and primes sideways or up $20/gt across the board.”

“The December market’s been pretty quiet with lots of sideways talk and some rumblings of up $10-20/gt on shred,” said another Midwest scrap insider. “Gerdau Steel came out at $20/gt across the board earlier in the week for both their Cartersville and Petersburg mills. Yes sir, it’s a Christmas miracle!”

“Shredded scrap is definitely up, as feed stocks are down, but mills are trying to go sideways,” said another Midwest scrap insider on Dec. 4.

Based on a $20/gt ($20/mt) increase in Midwest shredded scrap pricing, the grade is seen settling at $385-390/gt ($391-396/mt), while busheling scrap is currently assessed sideways to potentially higher at $385-395/gt ($391-401/mt) on a delivered to mill basis. Ohio Valley HMS grades is expected to settle sideways to up for December near $315-335/gt ($320-340/mt), while P&S scrap, which settled flat in November, could settle sideways to higher near its November settle at $351-361/gt ($357-367/mt), scrap insiders told SteelOrbis.

In the US Northeast, scrap insiders said increased export demand could boost December scrap values as importing nations buy more US supply towards increased January shipments. December shredded grades are seen potentially up $20/gt ($20/mt) from November settles near $335-345/gt ($340-351/mt). Prime busheling grade material is likely to settle flat to potentially up near $340-360/gt ($345-365/mt), following its November sideways settlement, while P&S and HMS grades could finish flat to higher than November near $280-290/gt ($285-295/mt), and $295-310/gt ($300-315/mt), respectively, scrap insiders told SteelOrbis.

|

| |

Do you have any questions? Check out our FAQ! |

| Check out the most frequently asked questions about the service and products of StaalX. We are always here to chat with you in the chat boxes from the site or on the support telephone number below.

|

| | | Contact us websupport@staalx.com or +1 (708) 697-3227

Follow StaalX on

|

| |

|

|

| |

.jpeg)