Import long steel prices follow domestic mills higher; August scrap is seen sideways to up

Thursday, 24 July 2025 01:02:54 (GMT+3) San Diego

US import long steel pricing moved higher this week, fueled by reports from domestic steel suppliers announcing increases to posted prices, potentially making more room for imports to enter US markets at a competitive price level. Insiders added that a growing outlook for steady to higher US August scrap pricing - fueled by uncertainty over new tariffs - continues to be supportive for the long steel outlook.

Over the past two weeks, key steel suppliers Nucor and CMC have announced price increases of $20-60/ton on domestic rebar and wire rod products, which insiders say could potentially make imports more competitive, especially since as much as 80 percent of the US’ traditional long steel imports were coming from Eygpt, Algeria, Bulgaria and Vietnam. Those imports, insiders say, remain in limbo, pending recent long steel anti-dumping cases currently under review by the US Commerce Department. Insiders said in the interim, even as high risks could limit how fast they can react, production from Oman, Malaysia, and Turkey could potentially fill at least part of the gap.

On the tariff side, insiders tell SteelOrbis that recent threats by US President Trump to tariff Brazilian pig iron exports to the US by 50 percent effective Aug.1 could cause US mills to purchase more prime and shredded grades of scrap during the August buy cycle, potentially causing further price increases in domestic and import long steel prices.

As of July 23, it remains unclear whether the US president will follow through on his recent threats to tariff Brazil at 50 percent as Trump has used threats of higher tariffs as a negotiating tool in the past.

“These Brazilian tariffs could be a big deal,” commented one SteelOrbis import long steel market insider. “The US purchases about 100,000 tons of pig iron each month from Brazil for domestic steel production. If that’s not available because of the new tariffs on August 1, (mills) will have to buy more scrap as a replacement and that could push prime and shredded scrap prices higher.”

During the July scrap buy cycle, US Ohio Valley prime busheling scrap settled sideways to June at $435-460/gt ($443-468/mt), while shredded material closed unchanged versus June at $375-380/gt ($381-387/mt).

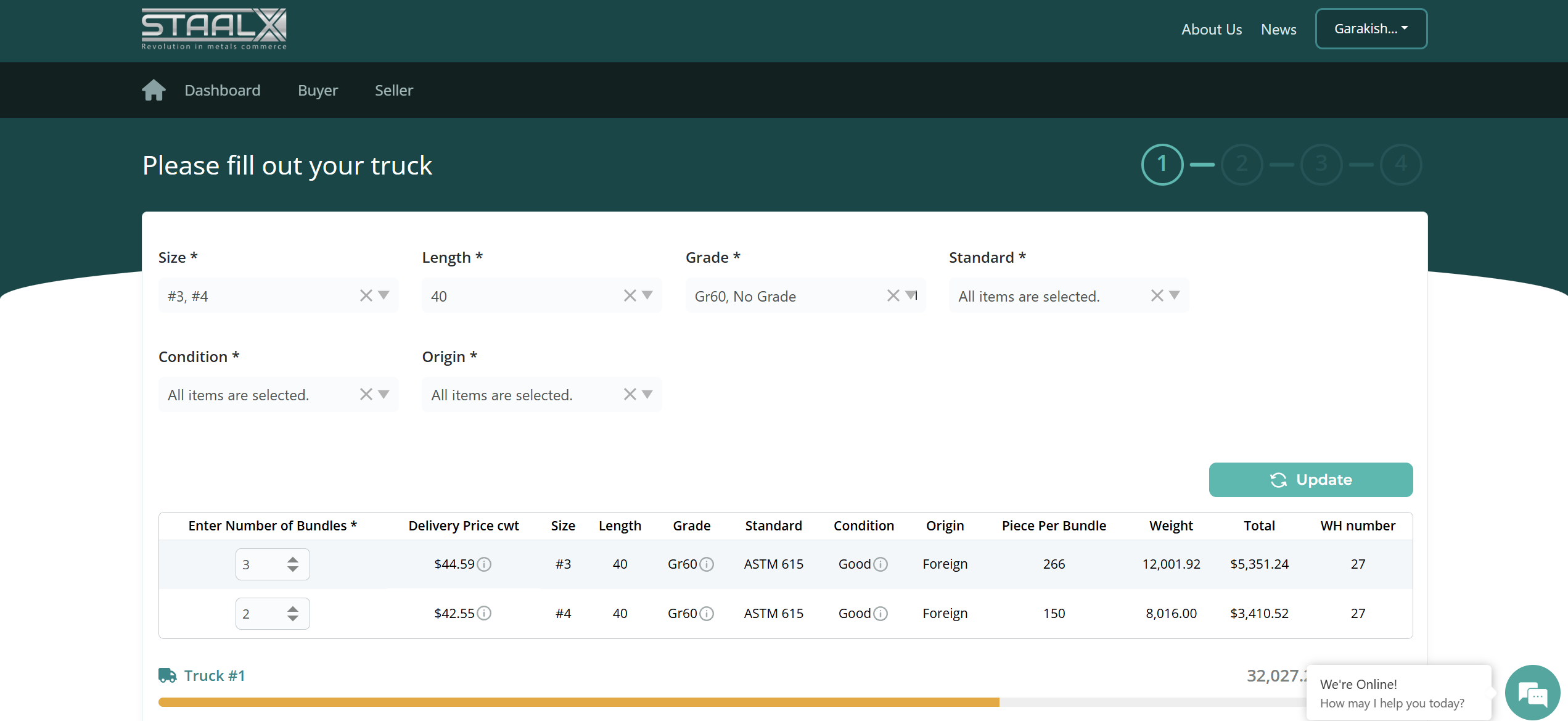

On the US Gulf Coast, import rebar on a loaded truck basis is discussed at $40-42.00/cwt., or $800-840/nt ($882-926/mt), up from week-ago pricing in the $39.50-40.50/cwt., range. Rebar supply from Mexico on a loaded truck basis vicinity Houston, Texas, is discussed higher at $40-42/cwt., as supplies contained in the US continue to be drawn down, insiders said.

“Demand across the US regions remains soft,” commented a Mexican supplier that sells into the US. “In Texas, order entry is particularly low, and our available inventory is currently limited as we prioritize fulfilling previously sold orders. Fabricators remain cautious,” he added, “and there’s still a wide gap between strategic price intentions and real-time market transactions.”

Imported rebar on a CFR FO USG basis not inclusive of tariffs is discussed $10/mt higher at $605-615/mt, while wire rod equivalent product also posted a $10/mt increase to $610-620/mt, importers told SteelOrbis.

In the import wire rod markets, insiders report weekly pricing slightly higher following domestic mill price increases from Nucor. Imported wire rod mesh on a DDP loaded truck basis USG is discussed at $44.50-45.50/cwt., up from previous workable import trade offers on a loaded truck basis at $43.50-44.50/cwt., market insiders said.

US domestic rebar up this week as wire rod stays flat

Thursday, 24 July 2025 18:32:24 (GMT+3) San Diego

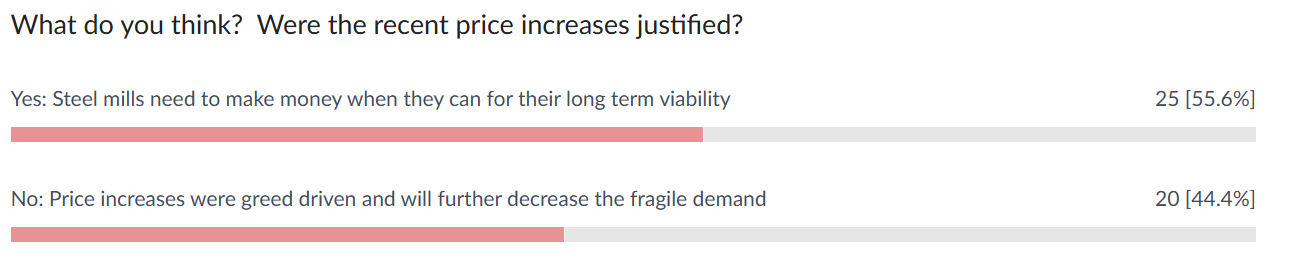

US domestic rebar is up this week while wire rod stays flat as scrap is reported to be sideways to higher in August. According to an official statement, Nucor has announced a price increase of $20/nt ($1/cwt) on wire rod transactions effective with new orders as of July 22. “Not everyone is happy with the announcements from both Nucor and CMC,” said a Steel Orbis insider.

In the weekly rebar spot markets, domestic supply on an FOB mill basis was assessed with most transactions noted at $43.50-44.50/cwt, ($870-890/nt or $959-981/mt), on average $44.00/cwt, ($880/nt or $970/mt), up by $2.00/cwt, ($40/nt or $44/mt), from seven days ago. “Usually, there is a $20/nt spread between domestic rebar and imports,” according to a Steel Orbis long steel contact. “Add another $60/nt ($3/cwt Nucor increase from July 18) and that makes room for imports. From a domestic mill standpoint, we are in dangerous territory right now.”

In the domestic wire rod market, domestic supply on an FOB mill basis was assessed with most transactions reported this week at $46.50-47.50/cwt ($930-950/nt or $1,025-1,047/mt), or an average of $47.00/cwt ($940/nt or$1,036/mt), unchanged from seven days ago. “Liberty Steel is setting pricing depending on the size of the buyer,” said another long steel contact. “As they continue production, it seems they are raising prices for smaller buyers,” he continued.