US import long steel pricing flat to down on limited demand with tariffs, reciprocal deadlines extended

Thursday, 10 July 2025 17:55:24 (GMT+3) San Diego

US import rebar and wire rod pricing was steady to slightly less this week as demand for import material remains limited following the June 4 implementation of 50 percent steel tariffs, market insiders told SteelOrbis. Uncertainty among steel importers remains heightened with many buyers and sellers sidelined pending an extended Aug. 1 deadline for affected countries to re-negotiate their current reciprocal tariff levels with the US Department of Commerce.

Spot market insiders say long steel importers, facing higher delivered costs amid ongoing 50 percent Section 232 steel tariffs, report few buyers yet willing to accept their higher offers versus domestic material, even as domestic long steel prices have been moving higher since tariffs went into affect. This week, reports of limited import rebar sales at reduced prices were noted, as sellers attempt to maintain cash flows as import demand stalls.

“So far, markets are flat this week,” remarked one import long steel insider. “Demand (for imports) is just no good.” “I hear import offers slipped to $40/cwt from $42/cwt, maybe temporarily, since importers need to raise money,” said another import steel insider to SteelOrbis.

Reports indicate the doubling of steel tariffs from 25 percent to 50 percent effective June 4 has increased the delivered price of import rebar and wire rod by $6.00-7.00/cwt., making much imported material non-competitive against domestic supply. Recent price increases by domestic mills has “yet to increase domestic pricing to the point where imported material makes sense,” insiders said.

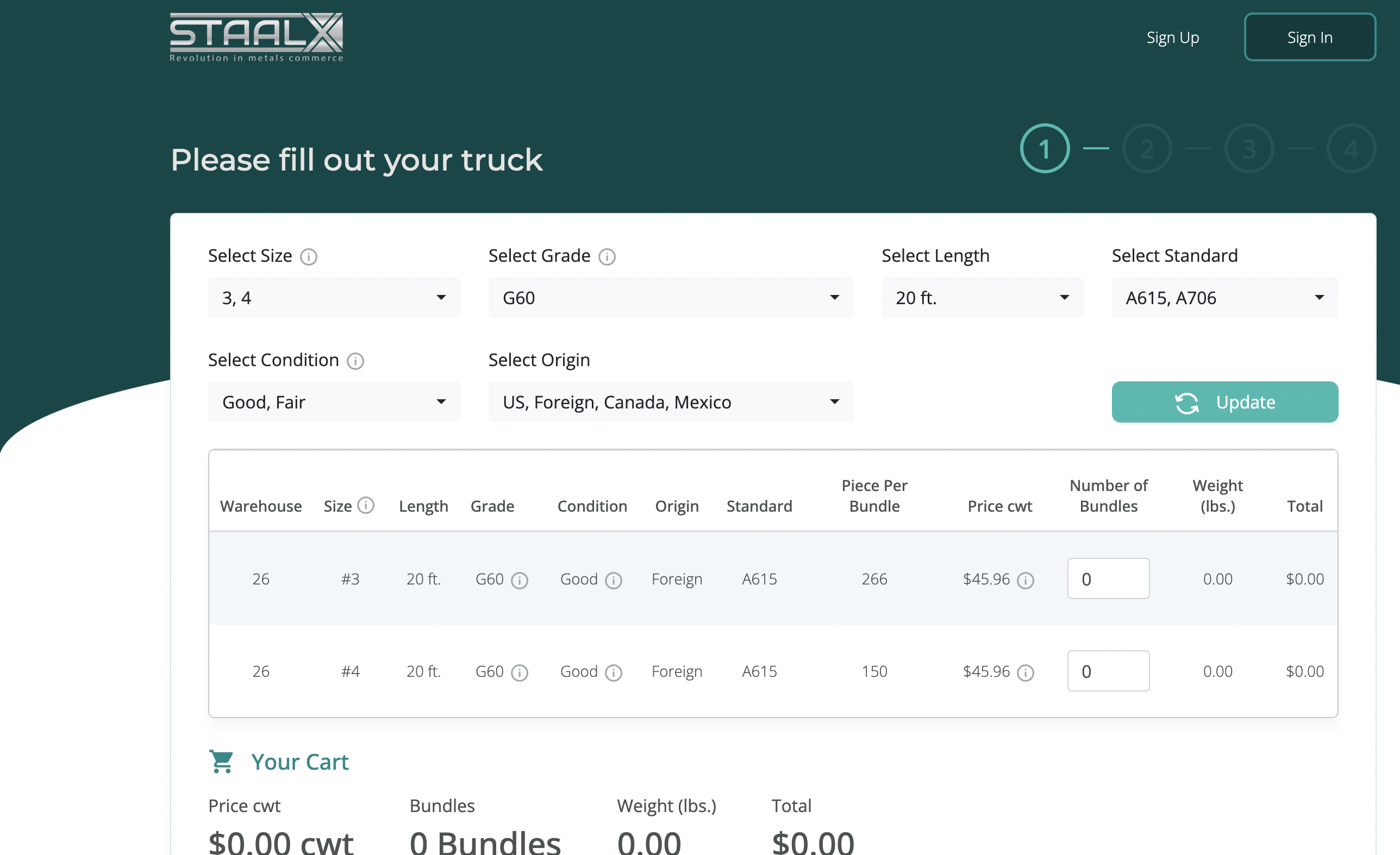

As high pre-tariff inventory continues to be drawn down on the US Gulf Coast, import rebar on a loaded truck basis vicinity Houston is offered at $39-41/cwt, with most offers noted slightly less on average at $40/cwt, off from $39-42/cwt., one week prior.

“Current pricing is supported by (import) inventory constraints, even as overall demand lags,” reported one Gulf Coast long steel importer. “Ongoing Section 232 tariffs and pending negotiations with Mexico and Canada continue to cloud visibility for new bookings.”

Rebar inventory from Mexico staged in Texas on a loaded truck basis is offered steady at $39.50-42.50/cwt., little changed versus previous $40.00-$42.00/cwt., workable trading ranges reported several weeks earlier.

Insiders say foreign producers continue to avoid the US markets until there’s more clarity on tariffs. On July 7, US President Trump issued an executive order extending the deadline for reciprocal tariff negotiations to be completed from July 9 to Aug. 1 as few country-specific deals remained inked. Fourteen major US trading partners received letters from the US administration stating individual tariff levels ranging between 25-40 percent in addition to any existing sector-specific tariffs.

“With little foreign material on the water, competition from imports remains limited for now,” the long steel importer added. “Especially, as sellers are reluctant to discount heavily in a low-volume environment.”

Long steel insiders continue to report price volatility could continue through July and now into August, as the market re-calibrates around new costs, continuing trade policy uncertainty, and potential retaliation from Canada and Mexico against the US, especially if tariff levels between the US’s two major trading partners fail to be re-negotiated before the revised August deadline. US President Trump stated this week in media reports that there will be no additional extensions for reciprocal tariffs.

In the wire rod markets, workable spot trade offers are yet again heard at $45-46/cwt., though few trades are expected to occur as import pricing remains higher than available delivered domestic supply, even as wire rod output reports from the recently restarted Liberty Steel wire and rod plant in Peoria, Illinois were unavailable.

US domestic rebar up slightly while wire rod stays flat though construction demand remains insufficient

Friday, 11 July 2025 22:50:02 (GMT+3) San Diego

US domestic rebar moves up slightly while wire rod stays flat as scrap remains sideways in July. “The demand [for longs] is still not good,” according to a SteelOrbis insider. Many construction contracts have been delayed due to the tariffs initiated by President Trump back in June. Since construction material prices have spiked, companies like Unistress Corp., in Massachusetts, have been forced to lay off hundreds of their employees. Still, the suppliers in the rebar segment seem to be a bit bullish in their pricing, most probably due the limited supply on the import side.

In the weekly rebar spot markets, domestic supply on an FOB mill basis was assessed with most transactions noted at $41.00-42.00/cwt, ($820-840/nt or $904-926/mt), on average $41.50/cwt, ($830/nt or $915/mt), up $1.00/cwt, ($20/nt or $22/mt), from seven days ago.

In the domestic wire rod market, most transactions were reported this week at $46.50-47.50/cwt ($930-950/nt or $1,025-1,047/mt), or an average of $47.00/cwt ($940/nt or $1,036/mt), unchanged from seven days ago. Liberty Steel still remains active as of this week.

US scrap prices stable in July as tighter local supply balanced by low export demand, weak currency

Tuesday, 08 July 2025 17:49:10 (GMT+3) San Diego

Prices for US ferrous scrap for July delivery in the Ohio Valley and the Northeast remained unchanged this month compared to June. Continued reports of tightening domestic inventory were balanced by limited export demand and general weakness in international currency markets following the June 4 increase in Section 232 steel and aluminum tariffs from 25 percent to 50 percent.

US settled prices are below: