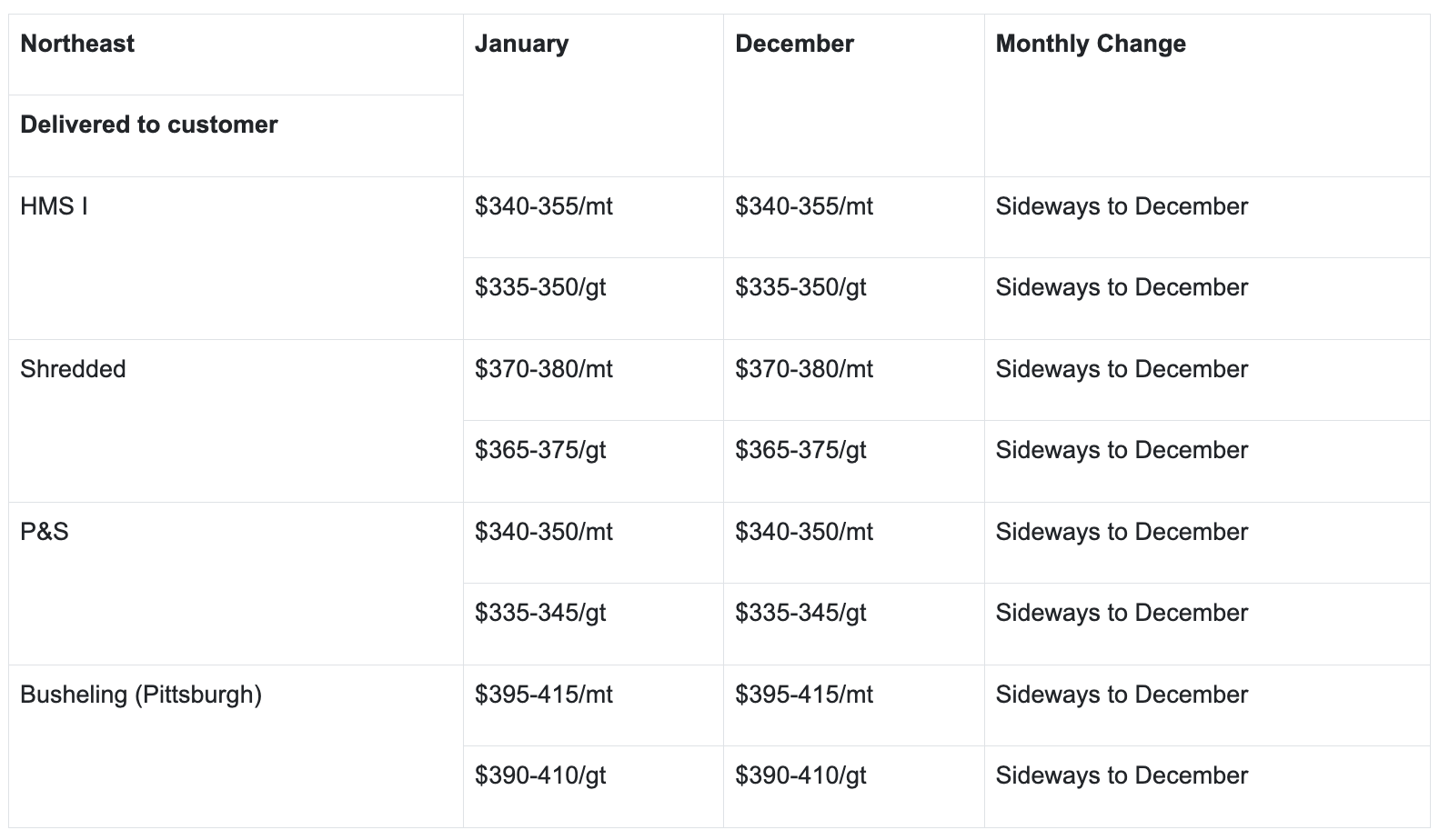

Updates From This Week Both rebar and wire rod announced $30/short ton raise On the heels of a scrap price increase of $20/ton, Nucor came up with a rod and rebar increase of $30/short ton this week. Nucor's business units make the pricing decisions independently. These increases were sort of expected after promising to keep the prices the same in January. While the market is still soft, the mills will have a better chance to get their price increase announcements accepted this time. On the rebar side, Nucor has been cautious not to make price increases and fail to get their customers to accept them. That's the reason they didn't join the price increase announcement made by CMC last month. Ultimately that increase announcement by CMC didn't go anywhere. Nucor sees better chances this time. February is really the best time to stock for construction season start and the import pipeline is relatively empty. Just a few importers have shipments for the first quarter since the domestic prices were too close to the import prices. In fact, spot domestic prices in Texas may be even lower than import prices at the ports. Domestic mills have fierce competition among themselves and more capacity is coming on-stream in 2025. In the works for 2025 is about 1.5 million tons of new capacity by CMC, Hybar and Ashoka Steel. Imports volume in 2024 was about 1 million so where will this new capacity go is the big question. This will likely push the imports down further and put further pressure on older mills. Already in wire rods, several mills are under stress. Liberty Steel (Both Illinois and South Carolina) is idled and Nucor's Connecticut mill seems to be ceasing rod production permanently. There are talks that there may be other mills on the brink. Luckily, there is help on the way with the new administration. New import protection is quite likely to include Canada and Mexico in Section 232 tariffs and fresh additional tariffs could also be implemented towards other countries. After all, steel was the favorite tariff weapon of the Trump's first administration and would be a low hanging fruit again for the second Trump administration to pick. We hope that the steel consuming and downstream industries will get some protection for their products this time. Otherwise, they will have to cope with even higher raw material prices than before and this will leave them vulnerable to import competition for their end products. No matter how much the administration tries to protect the steel making industry, the US steel industry cannot survive without robust steel consuming industries. Quality Pipes, Reliable Supply StaalX now provides shipments of high-quality steel pipes, available to meet our clients’ needs. Reach out to us today at trading@staalx.com to see how we can help you. StaalX is attending World of Concrete & SteelOrbis Events StaalX proudly sponsors SteelOrbis' Rebar & Wire Rod conference on Monday, January 20, 2025. This is the only steel-focused event scheduled alongside the World of Concrete — a can’t-miss networking opportunity for concrete reinforcing professionals. Our CEO, Murat Askin, will be moderating and speaking at the event, sharing valuable insights with attendees. Click the image above to learn more about the event and register! We also look forward to meeting you at our N2844 booth at the World of Concrete to learn about your needs and how StaalX can help you source competitively priced products when you need them. From our content partner, SteelOrbis US domestic rebar and wire rod pricing remains flat so far in the new year|Thursday, 09 January 2025 19:16:14 (GMT+3), San Diego "It's been a very slow start for the new year," one long steel market insider told SteelOrbis. "There's plenty of supply availability, and domestic mills are fighting with each other to maintain market share," said another market insider. "So, as a result, prices are little changed." In the weekly rebar spot markets, domestic supply on an FOB mill basis is assessed with most transactions noted unchanged from assessments made prior to the holidays at $36.00-37.00/cwt. ($720-740/nt or $794-816/mt), on average $36.50/cwt. ($730/nt or $804.69/mt). In the domestic wire rod market, most transactions were reported steady at $39.00-40.00/cwt. ($780-800/nt or $860- 882/mt), or an average of $39.50/cwt. ($790/nt or $870.83/mt). Near term, wire rod prices could be poised for an increase as supply is expected to decline. "The wire rod price could jump this month," said yet another SteelOrbis insider. "Nucor Connecticut announced they will no longer produce wire rod at their Connecticut plant because they are not competitive in the market which could potentially cause a spike in pricing, especially if President- elect Trump increases tariffs." Insiders also said near-term long steel pricing could increase if January scrap pricing proves higher. This week, as the January scrap buy-cycle begins, January scrap, which was earlier called sideways to December values, was discussed $10-$20/gt higher amid reports of continued low inventories at scrap collection facilities, as well as reports of new concerns with truck, river and rail transportation of scrap across the US Midwest as a result of this week's significant cold weather and snow. The National Weather Service said this week that a developing La Niña weather pattern is expected to bring wintry weather to areas not associated with snowy conditions to parts of the US South and Southeast. Late this week, second major winter storm Coral is expected to bring snow and ice into parts of Georgia as well as to sections of northern Texas around Dallas. "A bump up in scrap pricing could really help the rebar markets," a rebar insider told SteelOrbis. Recent scrap surveys indicate January shredded scrap pricing could increase by $10-20/gt, meaning delivered to customer pricing for January could settle at $385-400/gt ($390-405/mt). US import rebar and wire rod pricing remained steady this week in limited trade with markets reported quiet following the US Christmas and New Year holidays, though spot prices are poised for an increase as supply from imports is expected to decline, especially if the incoming US president proceeds with plans to increase tariffs after he takes office January 20, market insiders told SteelOrbis this week. This week's assessment varies little from the one reported prior to the Christmas and New Years holidays when few market insiders said they wanted to take new positions in steel ahead of Trump's likely expansion of trade tariffs. Trump has proposed 25 percent tariffs on Mexico and Canada, based on what he perceives as a failure on their part to control both the flow of illegal immigration and illegal drugs into the US, while China could see an additional 10 percent added to existing tariffs because he feels China has done little to control the flow of fentanyl into the US, mostly through the southern border with Mexico. "Long steel pricing and more specifically wire rod pricing could really jump if Trump proceeds with additional tariffs on imported steel," said one import rebar and wire rod market insider. "Less imports will increase the reliance on US production which is currently in question with the Liberty outage in Illinois and the new announcement from Nucor about the closure of their Connecticut wire rod facility." On January 7, steel maker Nucor said they would cease production of wire rod at their Connecticut steel mill due to "challenging market conditions," though they will continue to produce wire mesh, bright basic wire and rebar, the company said in a letter to its customers. "After thorough analysis, Nucor has made the decision to cease production of wire rod at Nucor Steel Connecticut," a company spokesman said. "(We) are forced to take this action due to challenging market conditions, including ongoing and historical surges of wire rod imports from trading partners such as Canada, Greece, Mexico, Poland, and Ukraine." According to import data from the International Trade Administration, total wire rod imports for 2024 were 987,738.83 metric tons (mt), up from 828,761.44 mt in 2023, for a yearly gain of 158,977 mt, or a 19.2 percent increase. The US's top three trading partners for wire rod continue to be Canada, Japan and Brazil. On the import rebar front, pricing remains steady on reported sales from Egypt on a delivered-to-customer basis at $36.50/cwt. ($730/nt or $805/mt). Insiders expect import pricing from Egypt to remain in the $36.50-37.00/cwt., range near term, with additional cargo bookings from Malaysia and Vietnam likely to keep prices in check. On the US Gulf Coast, imported rebar is priced $35.75- 36.75 cwt. ($715-735/nt or $788-810/mt) on a loaded truck basis, unchanged from earlier assessments, insiders said. Following earlier declines, rebar on an East Coast loaded truck basis is assessed steady at $35.75-36.75/cwt. ($715- 735/nt or $788-810/mt). In the Mexican export markets, insider say buyers remain hesitant to engage with sellers as a result of tariff uncertainty. Mexican rebar vicinity Houston on a loaded truck basis is discussed steady at $35.75-36.75/cwt. ($715- 735/nt or $788-810/mt). On the import wire rod mesh front, import material on a DDP loaded truck basis USG is discussed flat at $37.00/cwt. ($740/nt or $816/mt), following earlier weekly price strength as US markets moved higher amid uncertainty regarding the planned restart of the Liberty Steel wire rod plant in March 2025. US domestic scrap prices in the US Northeast region for January settled sideways versus December values on limited new domestic finished steel demand early in the first quarter, and amid mostly sideways to lower scrap export pricing. Settled prices are below:  Do you have any questions? Check out our FAQ!Check out the most frequently asked questions about the service and products of StaalX. We are always here to chat with you in the chat boxes from the site or on the support telephone number below. Contact us support@staalx.com or +1 (708) 697-3227 Follow StaalX on |

Do you want to get an instant quote?

Find rebar, wire rod, wire mesh and other construction materials on StaalX. Check availability and order with reliable delivery nationwide.

Browse products →